Current Account

-

Choice of currencies: open your account in Egyptian pounds or any other major currency1

-

Cheque book, debit card and periodic statements

-

Free online banking, mobile banking and 24-hour phone banking services

-

Open a new account through HSBC online banking2

-

Low account opening fee of EGP 50 and Monthly account maintenance fees of EGP 16

Enjoy convenience and flexibility for all your essential banking needs.

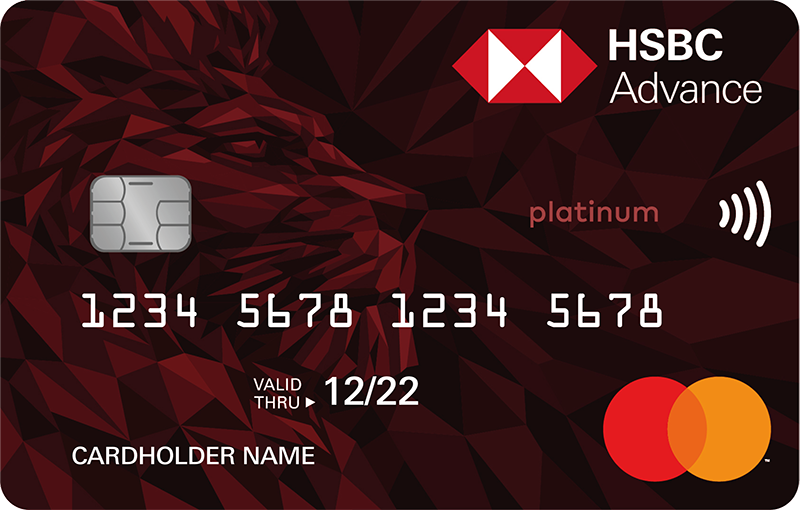

HSBC Advance

-

Current account available in any major currency

-

Free branded cheque book and international HSBC Advance debit card

-

Free HSBC Advance branded Platinum credit card

-

Free online banking, mobile banking and Global View service for all your HSBC accounts

-

Free 24-hour phone banking

-

No account opening fee

Preferential day-to-day banking services to help you make the most of tomorrow's opportunities.

HSBC Premier

-

Dedicated Relationship Manager and wealth management services

-

Free HSBC Premier branded credit card

-

HSBC Premier privileges

-

Free online banking, mobile banking and Global View service for all your HSBC accounts

-

Free 24-hour phone banking

-

No account opening fee

HSBC Premier focuses on the most important economy in the world: yours.

Savings Account

-

Interest on your credit balances

-

Choice of currencies: open your account in Egyptian pounds or any other major currency

-

International debit card and periodic statements

-

Immediate access to your money

Start saving today for your future.

Youth Savings Account

Our savings account especially for 15 to 20 year olds.

Time Deposit Account

-

Competitive interest rates

-

A choice of currencies: open your account in Egyptian pounds or major foreign currencies

-

Deposit funds for a pre-specified period, ranging from one week up to 36 months, at a fixed interest rate

-

A roll-over facility to automatically renew your deposit

Grow your money with higher interest rates.

Savings Certificates

-

A rate of 18% per annum

-

A certificate issued in EGP and in the name of the owner

-

3 year validity and tax exemption

-

Interest paid monthly and credited to your current or savings account

Enjoy the benefits of medium-term savings in Egyptian pounds.

1Current account opening is subject to special approval for non-residents.

2The new account will be linked to an existing account and will have the same currency.

3Total net annual income =net salary over 12 months plus the average from the last 2 years variable pay.

4 You'll be charged a monthly service charge of EGP 600 if you don't maintain a minimum average relationship balance of EGP 2,000,000 (or equivalent in a foreign currency) with HSBC Bank Egypt.

5You'll be charged a monthly service charge of EGP 250 if you don't maintain a minimum average relationship balance of EGP 500,000 (or equivalent in a foreign currency) with HSBC Bank Egypt.

6Accounts will be automatically closed after 3 months with zero balance.

7One Youth Savings Account in Egyptian currency is available per customer, with a preferential interest rate on savings up to EGP 50,000. The normal interest rate will apply to the total account balance if your savings in Egyptian currency exceed EGP 50,000 (including any interest you've received).